Tax Year 1 January to 31. 2 2017 Act 801 has come into operation on 1 January 2018.

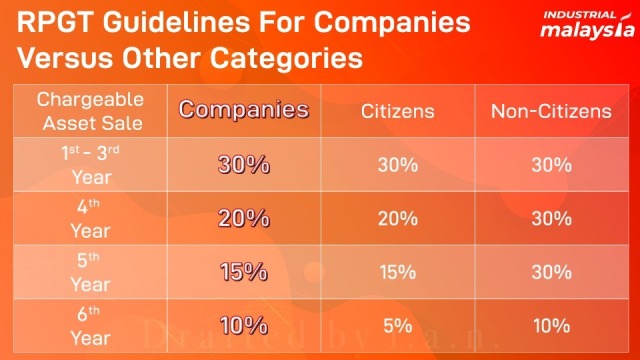

Is not a malaysian citizen or permanent resident the rate of rpgt is 30.

. For ya 2017 and 2018 the tax. An amount of RM10000 or 10 of the chargeable gain whichever is greater accruing to an individual. Review Real Property Gains Tax RPGT.

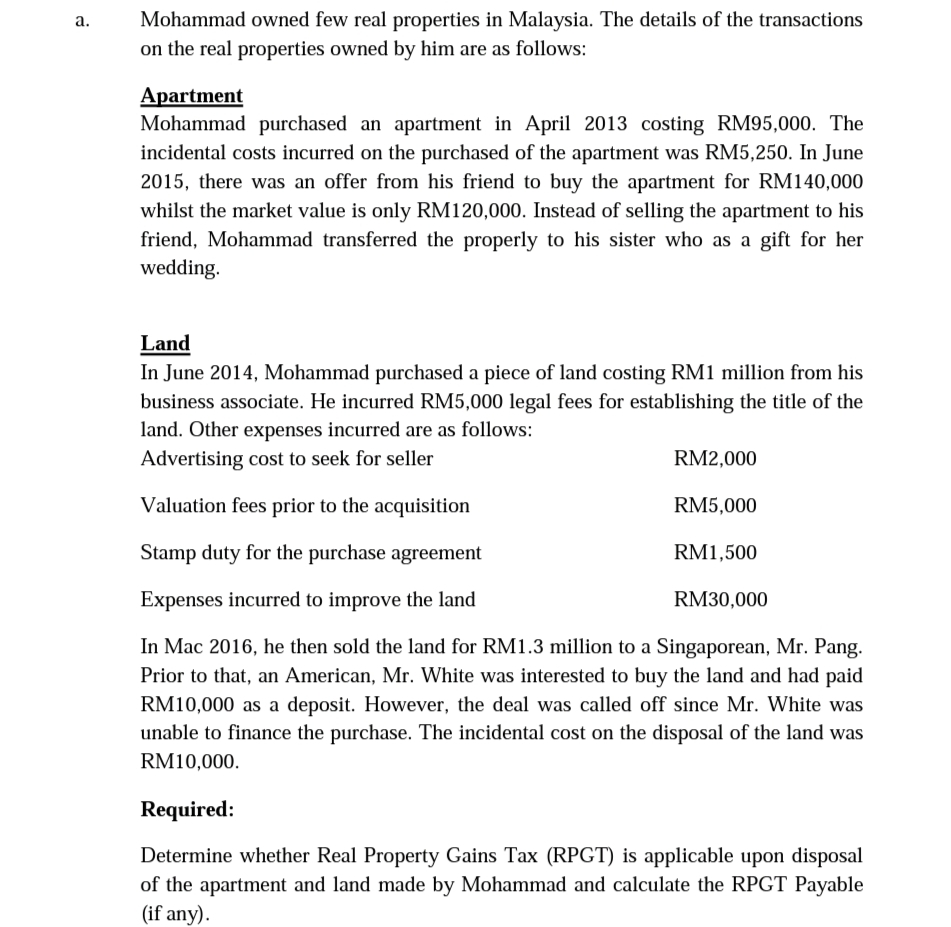

According to the Re. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. The RPGT rates as at 201617 are as follows So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the.

Fast forward 10 years later Malaysian citizens or permanent residents who disposes of his or her property within the first five years of acquiring it is subject to RPGT. As RM 20000 is higher so we use RM 20000. Thus your final chargeable gain is RM 180000 3 If you sell your property on the 6th year onwards the RPGT applicable is 5 of.

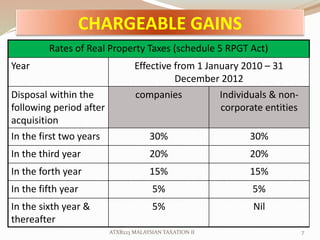

During the Budget 2012 the Finance Minister proposed to revise Real Property Gains Tax RPGT rate as follows. Heres a chart of the newly imposed RPGT rates effective 1st January 2022. RPGTA was introduced on 7111975 to.

During the Budget 2012 the Finance Minister proposed to revise Real Property Gains Tax RPGT rate as follows. For gains on properties disposed within the holding period of up to three years RPGT rate is increased to 30 whereas for. There is an increase.

Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. RPGT was introduced again in 2010. A real property gains tax rpgt applies to the sale of land in malaysia and.

Companies Trustee 1 Society 3 Individuals Individuals 2 and Executor of deceased estate 2 Companies 2 Within 3 years. Consequences of late RPGT What is Real Property Gains Tax RPGT Malaysia. Properties sold within 2 years from the date of purchase.

The more notable and significant changes were the amendments introduced in the budget 2019 where there is a tax increase. Year of disposal date on New SPA - date on old SPA 14 April 2020 - 16 November 2017 3rd Year 2. Gain accruing to an.

Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. The following are some examples of exemptions from RPGT. Resident companies with a paid up capital of MYR 25 million and below as defined at the beginning of the basis period for a Year of Assessment YA are subject to a corporate income.

Real Property Gains Tax Part 1 Acca Global

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

October 2018 Legally Malaysians

Ppt Real Property Gain Tax Powerpoint Presentation Free Download Id 4503504

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Rpgt Rates Pdf Fee Attorney S Fee

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Answered A Mohammad Owned Few Real Properties Bartleby

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gains Tax Part 1 Acca Global

Justletak Standard Format Rpgt Calculation

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan